5 unexpected costs of homeownership

It's no secret that becoming a homeowner is a big deal. Between making monthly mortgage payments and handling your own repairs and maintenance (so long, landlords!), homeownership comes with a lot of new responsibilities.

It can also come with additional costs that may have never crossed your mind. The average household spends close to $4,000 a year on unexpected repairs, according to a 2022 report—and that's not including all the other unforeseen taxes and fees you could face.

Don't get sideswiped by surprise expenses. From trash pickup to monthly maintenance, here are five additional costs you may need to build into your budget.

1. Property taxes.

When you become a homeowner, you don't just have to pay your mortgage—you also owe property taxes, which are calculated as a percentage of the assessed value of your home.

Property tax rates vary widely from state to state, and the amount you owe also depends on the value of your home.

For example, if local property taxes are 2% and your home is assessed at $200,000, you would owe $4,000 a year in property taxes. That number would go up for a more expensive home and decrease for a house assessed at a lower value.

Different states and localities offer different options for paying your taxes. Some homeowners set aside property tax payments in a monthly escrow account when they pay their mortgage each month. Others prefer to pay property taxes in one lump sum at the end of the year.

However you decide to make your payment, be sure to set money aside either through your mortgage lender or on your own, so you're prepared to pay your tax bill each year.

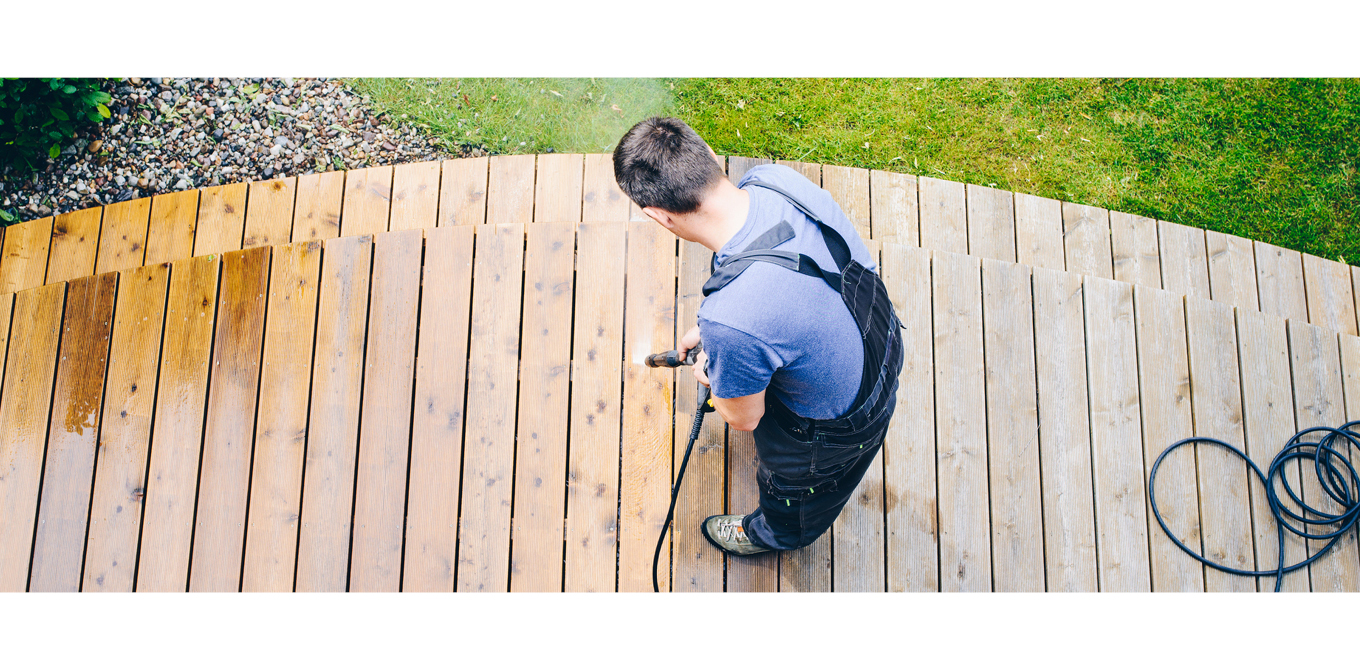

2. Unexpected maintenance and repairs.

When you become a homeowner, it's a good idea to expect the unexpected.

Surprise expenses are bound to pop up from time to time, whether your furnace dies in the middle of winter or you need to hire a professional to remove a dead tree from your yard. Costs vary based on the project and your location, but major home repairs—like a roof replacement or foundation repair—can exceed several thousands of dollars.

While you can't predict the future, you can plan ahead by setting aside money in a rainy-day fund. Bolster your savings account with regular contributions every time you get paid. That way, you'll be ready to face unexpected expenses that could come up down the road.

3. Trash pickup.

Chances are you already budgeted for utilities like gas, electricity, and water. But don't overlook the important (albeit smelly) task of trash removal, which can cost anywhere from about $20 to $80 a month, according to Moving.com.

Your garbage bill may come directly from your city or municipality, or the charge could be rolled into another bill, like your water bill. In addition to trash removal, keep an eye on your bills to see if you owe for other key local services, like snow removal or street lighting.

4. Condo assessments.

If you purchased a condo or a home within a homeowner's association, you may have already planned to pay monthly homeowner's association fees. But you may not have bargained for the cost of special condo assessments.

Special assessments are extra fees you may owe if your building or homeowner's association faces a large, unexpected expense. These one-time fees are usually distributed among all homeowners within an association to help offset an expense that isn't covered by your monthly dues or your HOA's reserve funds.

Assessments shouldn't come up often, but it's a good idea to be aware that they occur. It's common to see special assessments in the event of an emergency, like major building damage from a storm or a broken elevator that needs to be replaced. The exact amount you owe will depend on the cost of the project and the number of homeowners in your association.

5. Special city levies.

Similar to condo assessments, levies are one-off expenses that might come up for improvements in your neighborhood or city.

Your property taxes help fund your local municipality, but in some cases, you may have to pay a little extra for a levy that provides additional services in your community. For example, if the residents on your block petition the city to add a new speed bump, you may receive a bill to help pay for a portion of the project.

States and municipalities impose limits on levies, which means your city can't send surprise bills left and right—but it's still a good idea to be prepared in case a levy comes up.

Owning a home can be challenging but also rewarding. By going into homeownership with your eyes open to all the potential costs, you'll be mentally and financially prepared to handle one-off repairs and recurring bills.