Personal Finance: 5 Tips for Freelancers

Whether refurbishing furniture, providing rides from the airport, or doing web design, many people today work as freelancers or have a side gig. And they're increasingly turning those side hustles into their main income stream. Freelancers get to set their own schedules, scale their hours up or down, and choose their clients. Plus, they don't rely on just one income source. That said, when you can't rely on an employer's steady paycheck, your income will vary. And a fluctuating income stream can complicate how you manage your money.

Personal Finance: 5 Tips for Freelancers

If you're considering the freelance life or have already leaped in with both feet, check out these 5 tips to stay on top of your finances, including how to plan for tax payments and even retirement.

1. Separate your business and personal finances.

Many freelancers set up LLCs for liability protection and tax benefits. If you're included in that group, don't let your business and personal finances play in the same sandbox. Make sure you open bank accounts dedicated to your business, including business checking and business saving. Use a business credit card to make it easier to keep business expenses separate from personal ones. This will simplify your life at tax time and protect your personal finances.

2. Plan your budget to accommodate the low end of your income.

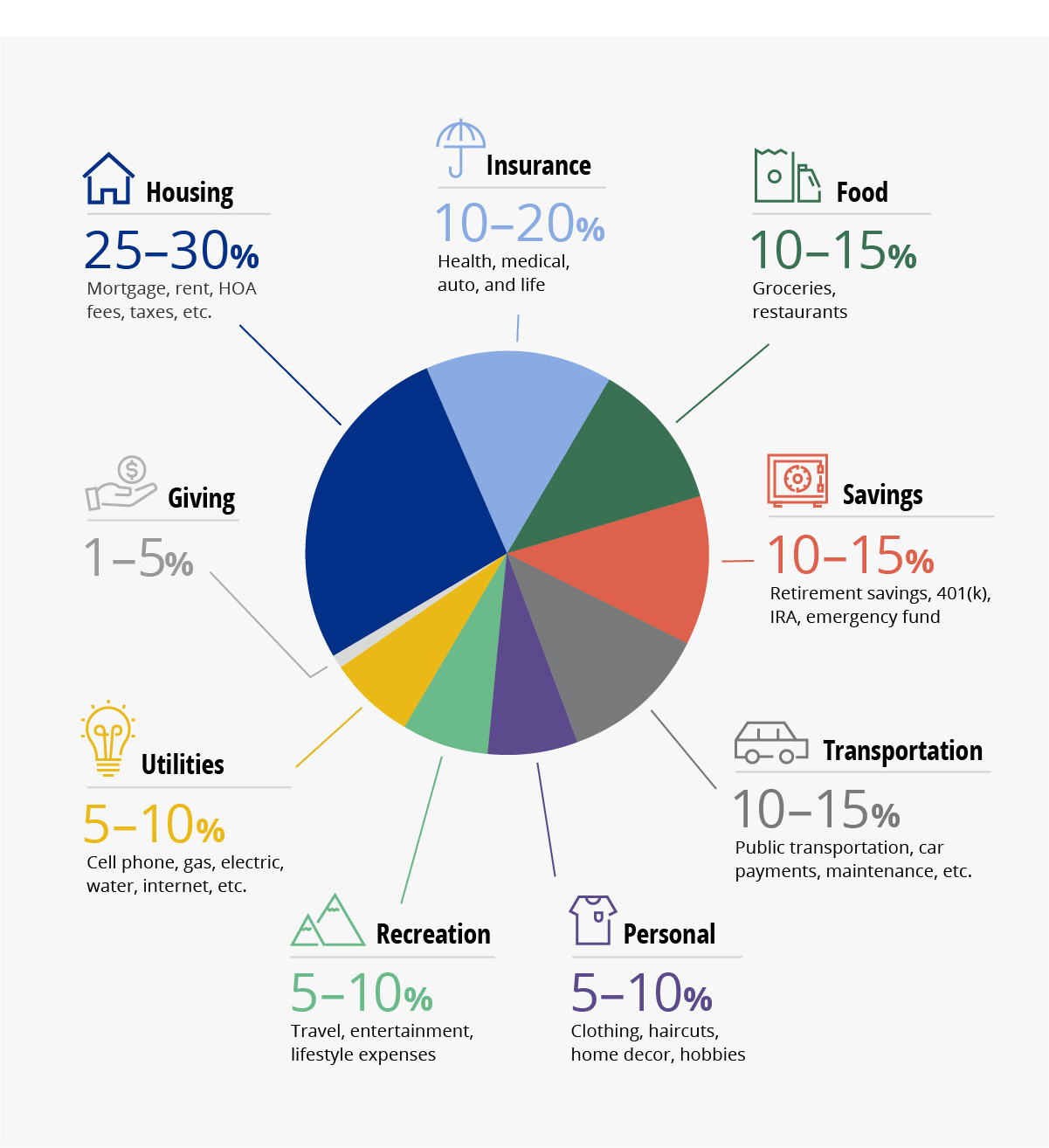

Be prepared for ups and downs. Look at your income by month. Are there any trends indicating when it typically dips? During your lower-income months, how much money did you bring in on average? Plan your budget based on this lower income. Doing so allows you to remain comfortable during any lulls—and to sock away extra money during your higher income months. Make sure to account for all fixed expenses like insurance (all types), rent/mortgage payments, utilities, etc. When it comes to variable expenses like entertainment and travel, you can adjust your budget according to your income. Just try not to spend all the extra gravy during good months. You'll thank yourself later.

3. Boost your emergency fund.

The general rule of thumb for emergency savings is to set aside an amount that could cover three-to-six months' worth of expenses. But if your income fluctuates, you may want to set aside even more. You can also consider opening a separate personal savings account that serves to supplement your income when you have a relatively slow month. This will help protect your emergency fund during dry spells, so you can save it to guard against a real crisis.

4. Don't forget to plan for estimated tax payments.

To avoid late penalties, most freelancers and gig workers pay estimated taxes on a quarterly schedule set by the IRS. Once you determine your tax bracket and factor in state income tax, set aside that percentage of your income as it comes in. You can then pay your estimated tax payments in lump sums throughout the year. Be sure to track your expenses as they can reduce your taxable income.

5. Plan for retirement.

You don't get an employer-sponsored 401(k) with a match when you freelance; you're on your own for retirement planning. Depending on your plans and your income, research various types of retirement accounts—like an IRA, a SEP 401(k), or a Solo 401(k)—to decide what works best for you. Then consider your budget and determine how much you'll save each month. Your contributions can fluctuate with your income as needed, or you might choose to deposit a lump sum at the end of the year. Not sure what's best? Consider working with a financial planner to gain peace of mind while planning for retirement.

With a little upfront planning, you can keep money stress at bay and enjoy the freedoms of freelancer life.