How to manage your finances with multiple accounts

Most people need at least one checking account and one savings account. But having multiple bank accounts can help you manage your finances by separating certain expenses and keeping savings goals clear. The number of accounts that you need depends on your financial goals.

When deciding how to plan and manage your finances, consider the following reasons to help you find the best approach for you.

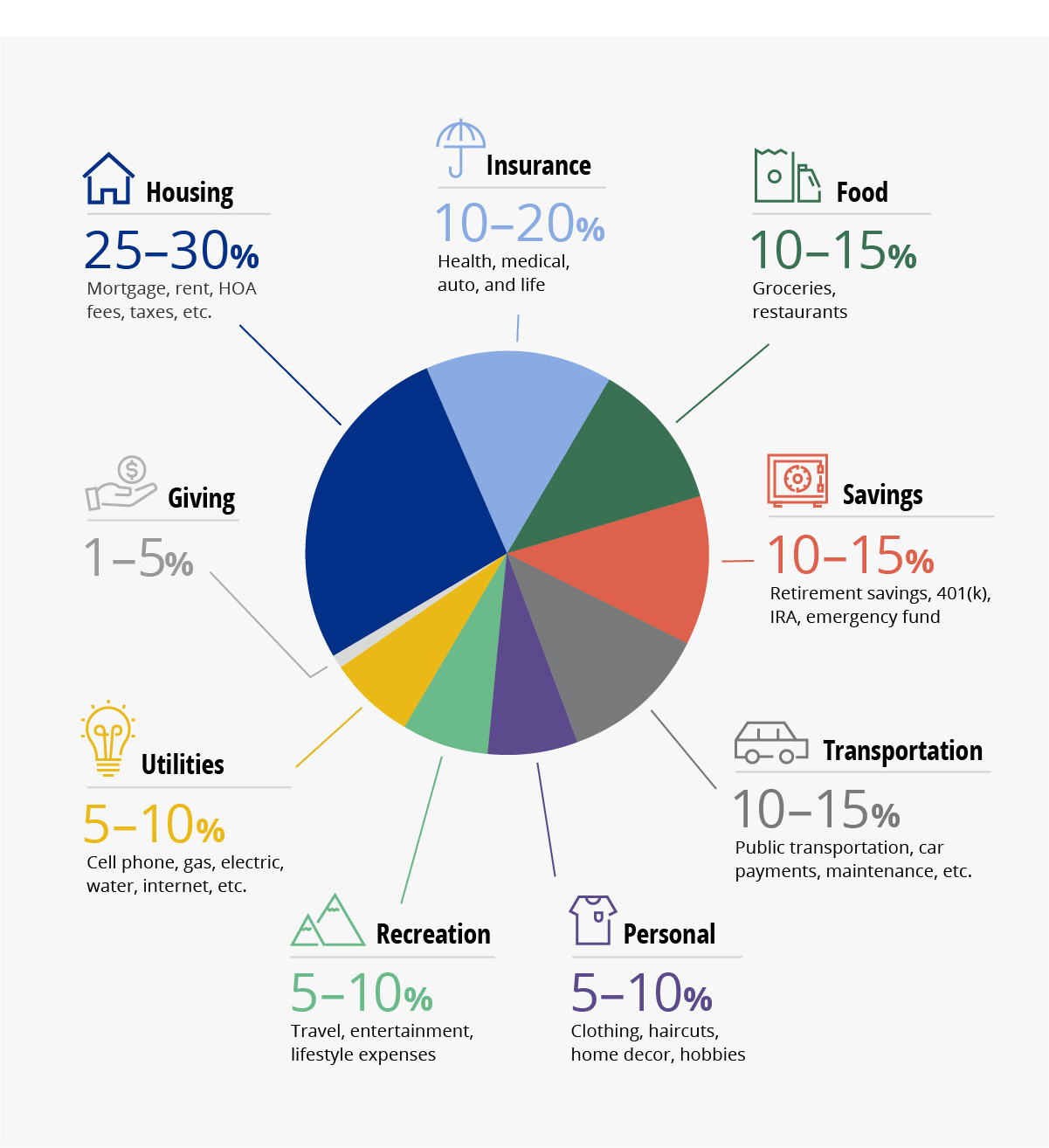

1. Stick to your budget. Most people have at least a few must-pay expenses, like rent or a mortgage payment, utility bills, gas and groceries. A household checking account reserved for these expenses can help you make sure your most important bills get paid first every month. Money that's leftover can be transferred to a separate checking account for lower priority expenses and items you want but don't need. Some financial advisers recommend allocating 50% of your income to needs, 30% to wants and 20% to savings.

2. Plan for big expenses. Major expenses may seem like emergencies, but there are some you can plan ahead for. Examples include property tax, car maintenance, an annual summer vacation and holiday shopping. Figure out how much you'll need for those expenses, and then set aside one-twelfth of that total cost each month in a dedicated savings or checking account to make sure you have the funds when the expenses come up each year. A holiday savings account can help you avoid burdensome credit card bills in January.

3. Secure your emergency savings. True emergencies, like natural disasters, job losses, and pandemics, are, unfortunately, a normal part of most people's lives. A dedicated emergency fund account can help you cope in the short term and recover in the long term. Three-to-six months of essential expenses is a good starter goal for emergency savings. Keeping that money in a separate account will help to ensure you don't accidentally spend it on everyday needs and wants.

4. Save for long-term life goals. Suppose you want to buy a home or a car. Or you want to get married or have a child (or another child). Maybe your goals include paying for your kids' college education, remodeling your home and taking the trip of a lifetime. Whatever your plans are, setting up separate savings accounts for each can help you save and keep track of your progress toward your goal. Saving for retirement? A tax-advantaged Individual Retirement Account may be a smart choice.

5. Separate your expenses. Whether from your spouse or because you’re self-employed, separate accounts keep your finances cleaner. By separating expenses from a significant other, you can save and spend however you prefer, even if one spouse sometimes disagrees with the other's priorities. This system also allows you to keep payments for any debt you owe individually separate from your joint accounts. If you have a business or side-hustle, it will streamline your bookkeeping and guard against co-mingling your personal and business expenses. Examples include office supplies, shipping costs, business meals and travel, subscriptions and conference and seminar fees. A business checking account will also help you track your business income and keep your business records ship-shape for tax time.

Bank checking and savings accounts make keeping track of your money easier and safer. They also come with convenient services, like debit cards, online bill payment, mobile deposit, opt-in overdraft protection and, if you're eligible, short-term cash advances of up to $1,000. The more accounts you have, the more you can take advantage of these and other benefits while you spend and save every day. How many accounts you should have depends on you.