How to Boost Your Retirement Savings

If you’re not paying attention, life can easily derail any retirement savings strategy. Particularly when you’re busy with a job, family, and other priorities. It’s important to remember that your future financial security most likely depends on how much you save during your career.

Saving successfully for retirement requires dedication so that you don’t get caught up in the expenses of everyday life. If you’ve reached the middle of your career and realized that life has gotten in the way and you don’t have as much saved for retirement as you'd like, don’t panic. By making small changes, you can still grow your retirement plan account.

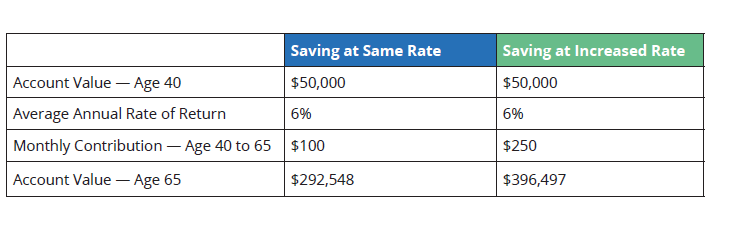

It might not be easy, but it’s possible. In the example below, the monthly contribution rate is more than doubled each month, but it pays off in retirement. Review your finances and create a budget to see how much you could increase your retirement savings by each month. Once you decide to increase your savings rate, make sure you have the amount automatically deducted from your paycheck each pay period so you won't be tempted to spend it.

This example illustrates how an increase in your savings rate can have a big impact on your retirement plan account1.

Click here to download the whitepaper.