Are Your Employees Prepared for Retirement?

On the list of issues we struggle with as a nation, saving money is near the top. There is no shortage of financial challenges that make saving money difficult, such as debt, lack of wage growth and the ever-increasing cost of essentials. And, let’s face it, we live in a consumer-based society that pressures us to spend. So, it probably won’t surprise you to learn how frequently we encounter individuals who have either fallen behind in saving for retirement or aren’t saving at all.

How Much Are We Saving?

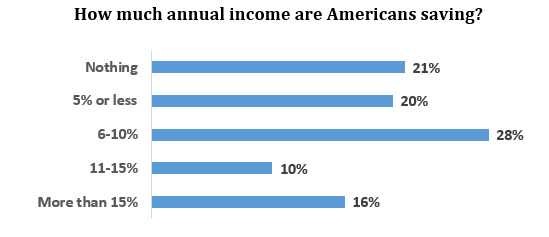

According to a recent Bankrate Financial Security Index survey, more than one in five working Americans aren’t saving any money for retirement, emergencies or other goals.

History Lesson

In 1967, nearly one-third of all Americans aged 65 or older lived below the poverty line. Fast-forward to 2012 and that number had been reduced to approximately 9%. This exceptional change is largely a result of Social Security, Medicare and defined-benefit pensions.

The way we think about planning for retirement today began with a small change in the tax code in the late 1970’s. The change was implemented to allow a few corporate executives earning high incomes to put aside a portion of their salary on a tax-deferred basis. Soon thereafter, the Reagan administration decided that companies should offer this benefit to all employees, and the 401(k) was born.

The original intent of the 401(k) was to provide a supplement to traditional pensions. Instead, companies began to drop their pension plans. Today, pensions are virtually non-existent in the private sector, and the burden of accumulating enough money to retire has fully shifted to working America with the workplace 401(k) as the cornerstone of how we save.

Retiree Regrets

Given the rapid elimination of pensions and lack of personal savings, retirement expert Teresa Ghilarducci of New York’s New School for Social Research, warns, “A greater percentage of the elderly will be poor or near poor than in the last 40 years.”

Unfortunately, Ghilarducci’s warning is echoed by a new report from Clever.com confirming that many American retirees regret their lack of planning when it comes to saving for retirement. The study found that of the 1,500 retirees surveyed, on average, retirees had saved approximately $179,000 in retirement funds; far less than the nearly $500,000, financial experts suggest. In fact, 65% of those surveyed revealed they have less than $50,000 saved.

Social Insecurity

Among those surveyed, social security was the most common source of retirement income. Not ideal, given that monthly Social Security benefits averaged around $1,514 per month, while typical monthly expenses were $3,900. The study found that overall, American retirees spend about $7,700 more than they bring in per year. As a result, many are forced to live modestly yet are still falling behind. This has resulted in many retirees returning to the workforce. While some choose to work because they enjoy it or for social reasons, most do so because savings and social security are not nearly enough to cover expenses.

Forced Retirement

Part of the challenge in preparing for retirement is funding longer life spans. At the beginning of the prior century, average life expectancy was just 47; today, it’s 84. That’s nearly two decades in retirement for an individual who retires in their mid- to late 60s.

Living longer is certainly a benefit, but many Americans are forced to retire earlier than expected due to health issues or unexpected job loss. These situations tend to place retirees in immediate financial difficulty. They lose additional time they may have counted on to save, and ultimately, are in retirement for a longer period than otherwise expected. And those who leave the workforce early due to illness typically experience even more hardship as they have additional medical expenses to cover.

Healthcare Woes

Retirees report medical bills are the most difficult expense to cover followed by groceries, credit cards, housing and other debts. In 2020 alone, American retirees doubled their non-mortgage debt to $20,000 just to cover general living expenses. More than half of those surveyed said they started saving too late, and nearly two-thirds wished they would have learned more about saving and investing early in their careers.

Education Is the Key to Success

At Fulton Financial Advisors, our goal is to understand the distinct needs of your employees. This provides the insight necessary to develop and deliver a financial education program using multiple delivery channels. Consistent reminders of how to prepare for retirement will dramatically increase the likelihood that individuals are more financially fit and better prepared for tomorrow.

In addition to retirement planning solutions, we have a robust offering of financial products that include traditional banking, mortgage, wealth and estate planning and brokerage products. Contact us today and we will help you develop a suite of comprehensive financial solutions tailored to meet the unique needs of all individuals who contribute to the success of your business.