For most of their life, retirement seems theoretical for working professionals. When it finally becomes visible on the horizon, however, it suddenly becomes very real—and questions can start to arise. Are you really ready to retire in the next year? Have you saved enough for the lifestyle you have in mind?

The only way to know for sure is to put pencil to paper and do some planning for the final stretch. It can be helpful to think through some of the basics on your own and then lean on a trusted financial advisor to confirm what you've learned and work through some of the more complex questions.

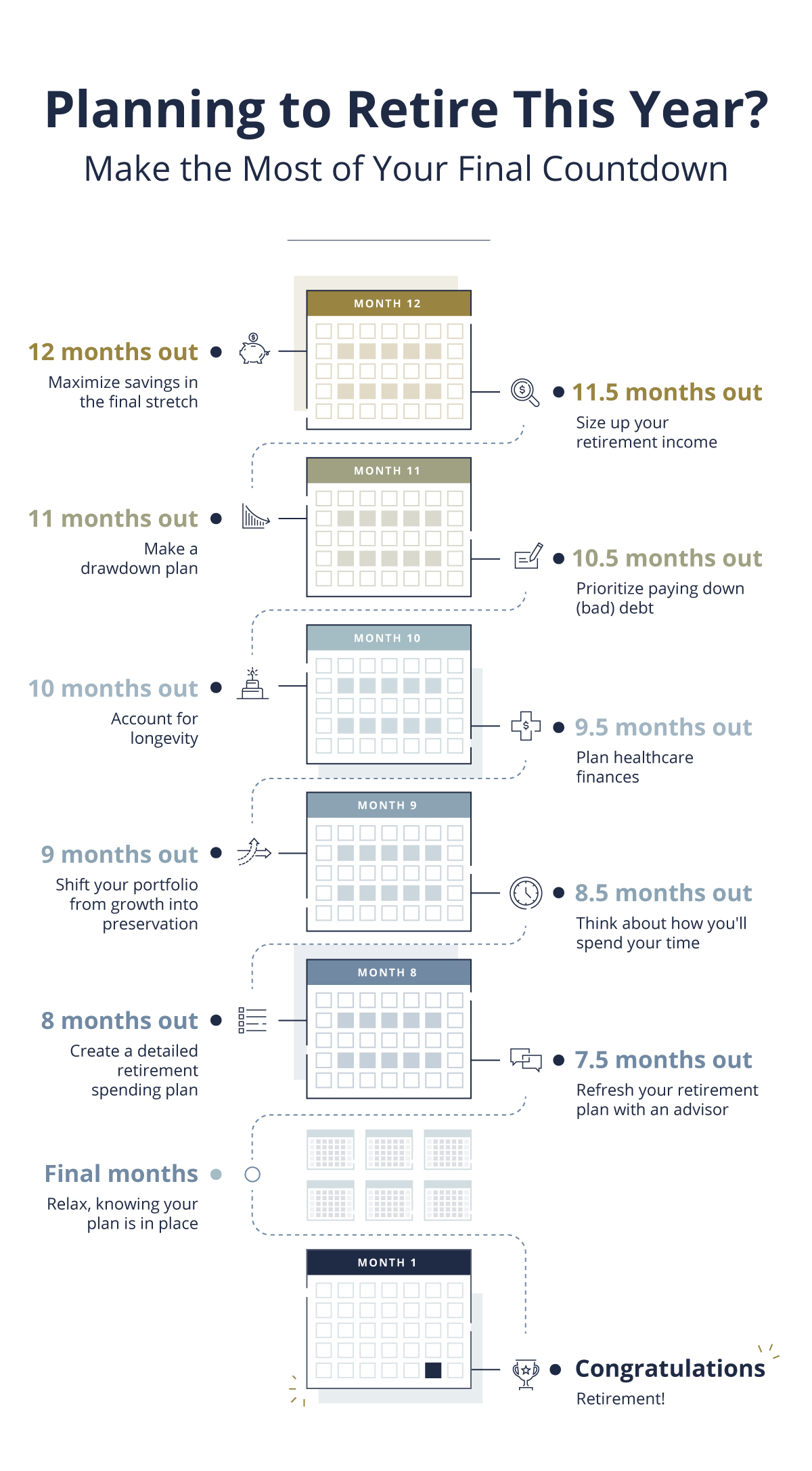

Here are 10 important steps to take in the year before retirement:

1. 12 months out: Maximize savings in the final stretch

Concerned you're not quite where you need to be savings-wise to meet your goals? Or want to add as much extra financial security as possible? In the last year of your working life, you likely qualify for contributing extra to your retirement savings through what the IRS calls catch-up contributions. While these can change when tax laws evolve, this IRS chart shows current contribution limits.

Also, consider maximizing your contributions to take full advantage of any matching contribution from your employer. If there's ever a time to boost your savings, right before retirement is it.

2. 11.5 months out: Size up your retirement income

You've always thought about your retirement funds as savings. Now, it's time to reframe your thinking—it's about to become your income. How much will you pay yourself each year? How much will you need?

These are complicated questions, and everyone has different answers. Generally speaking, many experts suggest that prospective retirees will need 70- 80% of their current income after retirement. To find out if you meet that bar, start by adding up the sources of income you know you'll have, including Social Security and any pensions, and get a ballpark estimate of how far it will go.

To estimate your Social Security income, you'll want to do an analysis of when you plan to start taking it, when to apply, and how much it will contribute to your retirement income mix. The following steps will help you get a clearer idea of how much you're working with and how much you need.

3. 11 months out: Make a drawdown plan

In addition to how much retirement income you'll need, it's important to strategize how you'll draw from your different income sources. These sources may include taxable, tax-deferred, and tax-free accounts. Plan to work through them in an order that minimizes your tax liabilities.

The rate at which you draw down your retirement savings matters, too. A Morningstar analysis found that retirees who withdrew up to 4% of their savings in their first year and then adjusted for inflation from there had a very high probability of having remaining funds in 30 years. Comparing that calculation to your target income is another way to assess your financial readiness for retirement.

4. 10.5 months out: Prioritize paying down (bad) debt

Nothing optimizes your retirement income like being debt-free. But if your retirement date is coming into view before your debt is paid off, you're far from alone. People in their 50s have a higher credit card debt than any other age group, according to a recent study.

Don't sweat "good" debt too much, like your home mortgage or car payment—anything that leaves you with an asset in the end. Focus on paying down as much "bad" debt as you can. That includes credit cards or high-interest loans. If you have a good deal of bad debt, you may want to consider refinancing your debt, or doing a debt consolidation loan.

5. 10 months out: Account for longevity

If you're retiring in your 60s after a 40-year career, your next career—as a retiree—could last nearly as long. Not only does your retirement income need to last as long, but it also needs to account for how much your life and the world may change in that time. As you plan out your financial future, calculate inflation and possible economic turbulence over the decades to come.

Also consider how your needs may change, including long-term care. The U.S. Administration for Community Living estimates assisted living care to cost $3,628 per month and nursing home care to cost $7,698 per month—and that's in today's dollars!

6. 9.5 months out: Plan healthcare finances

No matter how healthy and long your retirement is, it will include healthcare expenses—likely, significant ones. Healthcare is complicated, and it only becomes more so as retirees navigate Medicare, supplemental insurance, and, often, chronic disease.

If you're retiring before 65, you won't yet be eligible for Medicare, so consider what health insurance you'll need after leaving your employer. If you're eligible for Medicare right away, it's important to know that Medicare doesn't cover everything. How will you pay out-of-pocket costs? Depending on your finances and health, you might consider a health savings account (HSA) or supplemental insurance.

7. 9 months out: Shift your portfolio from growth into preservation

Your risk level changes as you approach and enter retirement. After all, market volatility means something very different to someone relying on stocks to fund their lifestyle today versus 20 years from now.

Most near-retirees who plan to rely on their investment portfolio for living expenses should consider protecting their financial assets from market shifts, often by moving away from stocks and toward securities like bonds. The ideal mix will be unique to each person and economic environment, so getting the details right often requires a financial adviser's help.

8. 8.5 months out: Think about how you'll spend your time

What are you going to do with all of your time in retirement? It sounds like an obvious question, but generation after generation of new retirees find themselves surprised without an answer beforehand.

Whether it's golf, travel, a hobby, or family commitments, planning your retirement life is important for both your mental and financial health. Nothing will blow up your retirement finances like realizing your post-work life feels unfulfilling without an unplanned amount of world travel or a country club membership. Consider your needs in advance, and you can look forward to a happy retirement that aligns with your financial plans.

9. 8 months out: Create a detailed retirement spending plan

Now that you have a framework for what your income, expenses, and activities will be like in retirement, you can make a spending plan—something akin to a budget. Even if you never operated with a budget before, tracking and monitoring your spending becomes newly critical in retirement. During your working life, there was always more money coming in. When money is only going out, you'll want to watch it more carefully.

Consider your living expenses and the regular costs of enrichment and entertainment, from club memberships to cruises to holiday gifts for the grandkids. A budget doesn't mean you can't splurge; it just lets you know how much and how often you can afford to.

10. 7.5 months out: Refresh your retirement plan with an advisor

After a long career, you likely know the value of consulting an expert. Reviewing all the steps above is great, but most people will want to take their plans and calculations to a financial advisor to ensure their retirement plan is accurate and comprehensive, and accounts for as many variables as possible. Every family's financial situation is unique, and anticipating how retirement will impact each household is challenging. Approaching an expert financial advisor armed with all the information above, however, helps take a lot of the guesswork out of the last year ahead of retirement.

It's an exciting time. Retirement should be rewarding, not overwhelming. Let’s make sure your first year is your strongest yet. Connect with a Fulton Private Banker today to have further discussion around your retirement goals and plans!